working capital turnover ratio formula class 12

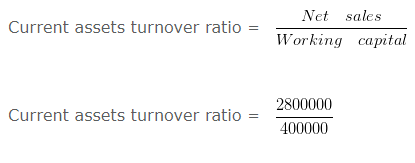

Working Capital Turnover Ratio. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times.

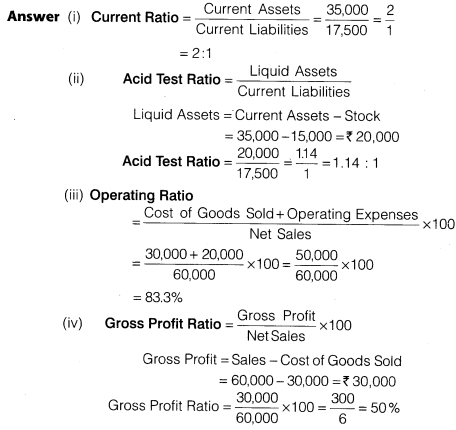

Pdf Ncert Solutions For Class 12 Accountancy Part Ii Chapter 5 Accounting Ratios

200000 and general reserve Rs.

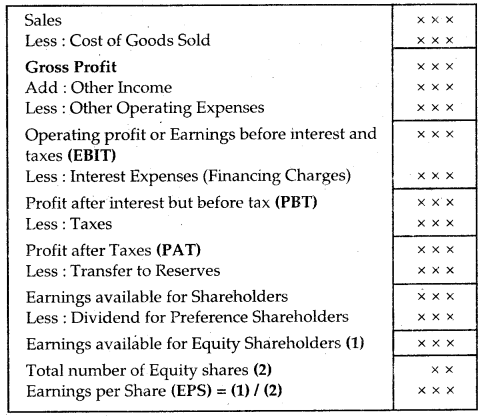

. Accounting Ratios CBSE Notes for Class 12 Accountancy Topic 1. Accounting Ratios CBSE Notes for Class 12. Total assets turnover ratio 3.

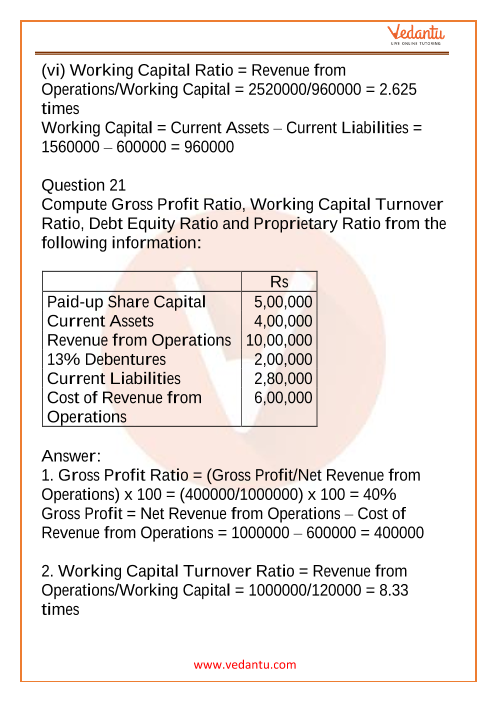

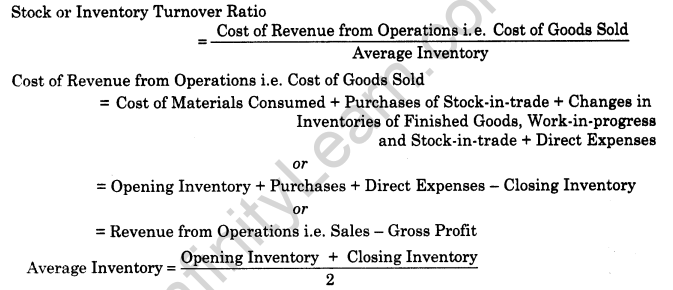

It is a ratio where firms. Working capital turnover ratio is used to measure the efficiency of a company in using its working capital to support the sales. Accounting Ratio Ratio Analysis Inventory Turnover Raio Or Stock Turnover Ratio Youtube Compute Working Capital Turnover Ratio If The Cost Of Goods Sold Is Rs 9 60 000.

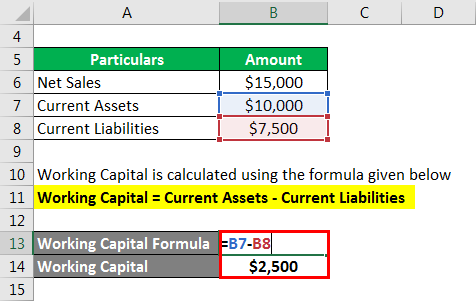

The working capital formula is. Working capital turnover ratio. Working capital turnover ratio Turnover ratio Class 12.

Working capital turnover is a ratio comparing the depletion of working capital to the generation of sales over a given period. Working capital turnover ratio 1. Working capital turnover ratio interpretation.

The mcqs for grade 12 accounting ratios have been updated based on the latest syllabus and examination guidelines issued by cbse ncert. Accountancy Class 12 Important Questions and. From The Following Information Calculate Up To.

Class12commerce WorkingCapitalTurnOverRatio accountingworking capital turnover ratio formula example class 12About Videoworking capital turnover ra. The ratio of working capital turnover is determined by dividing net annual sales for the same 12-month period by the average sum of working capital current assets minus current. Working capital turnover ratio class 12.

The formula for calculating working capital turnover ratio is. Asset Turnover Ratio Formula Accounting will sometimes glitch and take you a long time to try different solutions. It establishes the relationship between.

Working capital Current assets - Current liabilities Working capital 550000 - 180000 Working capital 370000 Working note 2. The formula for calculating working capital turnover ratio is. The ratio estimation formula is.

Working Capital Current Assets Current Liabilities ii Proprietary ratio It. Working Capital Current Assets Current Liabilities 1000000 100000 900000 3341 or 334 times. LoginAsk is here to help you access Asset Turnover Ratio Formula.

Net Working Capital and Revenue from Operations ie Net Sales. Working Capital Current Assets Current Liabilities ii Proprietary ratio It establishes the relationship between proprietors funds and total assets. Working Capital Turnover Ratio.

Working capital turnover is a ratio comparing the depletion of working capital to the generation of sales over a given period. Compute the working capital turnover ratio. I Debt equity Ratio.

Working capital turnover ratio Turnover ratio Class 12.

Turnover Ratio Formula Example With Excel Template

Study The Ncert Solutions On Accounting Ratios Chapter 5 Ncert Solutions For Class 12 Accountancy

Working Capital Turnover Ratio Meaning Formula And Example

Accounting Ratios Class 12 Notes Accountancy Chapter 10

Notes For Class 12 Accountancy Chapter 5 Accounting Ratios

Working Capital Turnover Ratio Formula Example And Interpretation

Accounting Ratios Cbse Notes For Class 12 Accountancy Infinity Learn

Ncert Solutions For Class 12 Accountancy Part Ii Chapter 5 Accounting Ratios

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios Merit Batch

Ratios Formulae Ratio Analysis All Formulae In Once Place

Working Capital Turnover Ratio Class 12 Accountancy Accounting Ratio Youtube

Showimage Php Formula 945cddda855d5f5bb1a42bca78d6c64f Png D 0

Ratio Analysis Class 12 Notes And Examples Accountancy Arinjay Academy

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

Ts Grewal Solution Class 12 Chapter 4 Accounting Ratios

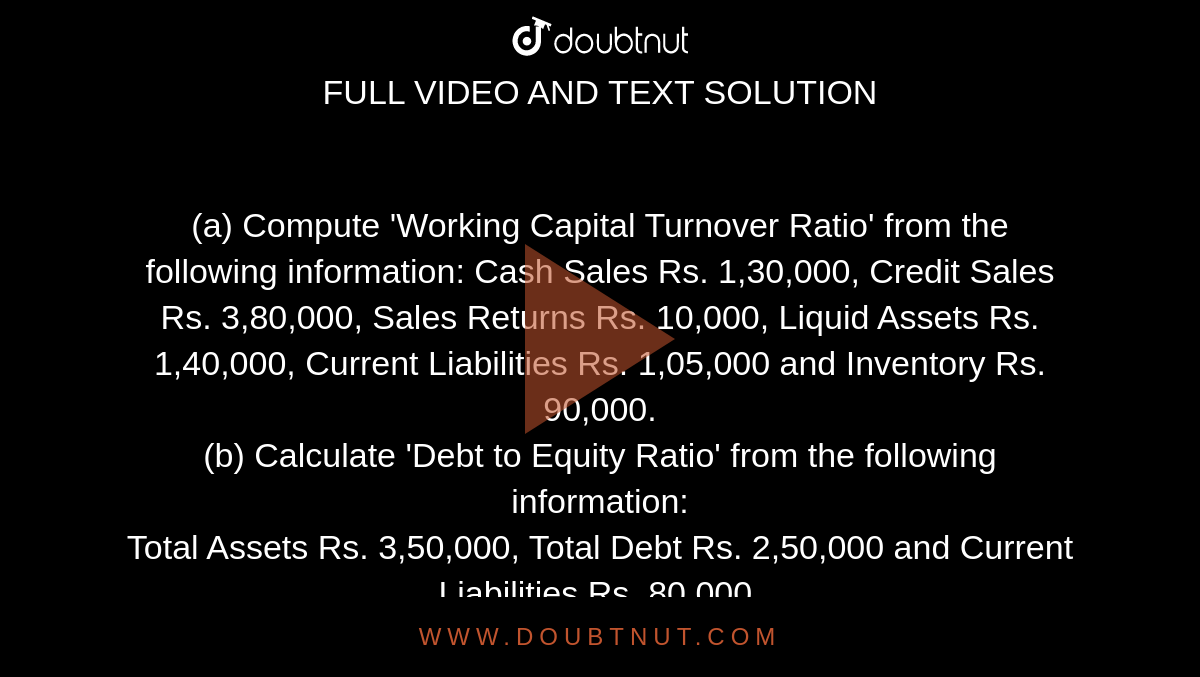

A Compute Working Capital Turnover Ratio From The Following Information Cash Sales Rs 1 30 000 Credit Sales Rs 3 80 000 Sales Returns Rs 10 000 Liquid Assets Rs 1 40 000 Current Liabilities Rs 1 05 000 And Inventory

Activity Ratios Debtors Creditors Turnover Ratios Stock Turnover Q A