does arkansas have an inheritance tax

Your spouse has the right to use for life 13 of your real estate. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you.

Arkansas State 2022 Taxes Forbes Advisor

Though your estate will not be subject to Arkansas estate or inheritance tax it is possible that federal taxes could affect your estate.

. Arkansas also provides to the surviving spouse and minor children a small property allowance from the estate up to a 4000 value along with personal property necessary for family use and occupancy of their dwelling. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met.

Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas. Delivery Spanish Fork Restaurants. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax.

The state sales tax rate is 65. The federal government does not impose an inheritance tax so the recent tax changes from the trump administration did not affect the inheritance taxes imposed by the states. Soldier For Life Fort Campbell.

Income Tax Rate Indonesia. Arkansas does not collect inheritance tax. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will.

Do You Have To Pay Inheritance Tax In Arkansas. However if you are inheriting property from another state that state may have an estate tax that applies. This article covers probate how to successfully create a valid will in Arkansas and what happens to your estate if you die without a will.

If an Arkansas resident dies without a will his property passes to his surviving spouse and other heirs according to state law. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. Arkansas does not have an inheritance tax.

Up to 25 cash back The Spouses Share in Arkansas. In Arkansas a resident can make a valid will if hes at least 18 years old and mentally competent. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that.

Does kansas have inheritance tax. Most states including Arkansas allow a surviving spouse and minor children to take an interest in the homestead of the decedent. Laws arkansas does not collect an estate tax or an inheritance tax.

Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Opry Mills Breakfast Restaurants. However if you are inheriting property from another state that state may have an estate tax that applies.

Inheritance tax of up to 18 percent. There are only seven states that have an inheritance tax. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

Arkansas does not have a state inheritance or estate tax. Restaurants In Matthews Nc That Deliver. Arkansas does not collect an estate tax or an inheritance tax.

If you receive an inheritance from someone living out-of-state make sure to check the local laws. Arkansas also has no inheritance tax. The Pennsylvania inheritance tax for instance applies to out-of-state inheritors.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. If you have children or other descendants. Inheritance and Estate Taxes.

Inheritance laws of other states may apply to you though if you inherit money or assets from someone who lives in a state that has an inheritance tax. States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. Therefore is a resident of.

Noarkansas has neither an estate tax nor an inheritance tax. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. In Arkansas whether or not you have a will when you die your spouse will inherit property from you under a doctrine called dower and curtesy Briefly this is how it works.

Arkansas law also requires a will to be written and attested by two witnesses. Arkansas does not have an inheritance or estate tax. Essex Ct Pizza Restaurants.

Many of the steps for probate in Arkansas are the same as in other states. Arkansas Taxes Differ from Federal Taxes. The state where you live is irrelevant.

Arkansas does not collect inheritance tax. The laws regarding inheritance tax do not depend on where you as the heir. NoArkansas has neither an estate tax nor an inheritance tax.

The will must be filed with the circuit court in the county where the decedent lived. Settling an Estate in Arkansas. They must be followed to ensure the estate is distributed as required by law.

Petition for probate may be filed at the same time. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Inheritance tax of up to 15 percent There are only seven states that have an inheritance tax.

The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Arkansas does not collect an estate tax or an inheritance tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Thank you so much for allowing me to help you with your question.

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Is There An Inheritance Tax In Arkansas

Individual Income Tax Arkansas Department Of Finance And

Arkansas Retirement Tax Friendliness Smartasset

Historical Arkansas Tax Policy Information Ballotpedia

Arkansas Advance Legislative Service Lexisnexis Store

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Arkansas State Highlighted Red Color On Usa Map Stock Illustration Download Image Now Istock

Complete Guide To Probate In Arkansas

Where S My Arkansas State Tax Refund Taxact Blog

Arkansas Inheritance Laws What You Should Know

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

Arkansas Inheritance Laws What You Should Know

What Happens If You Die Without A Will In Arkansas Cake Blog

Arkansas Inheritance Laws What You Should Know

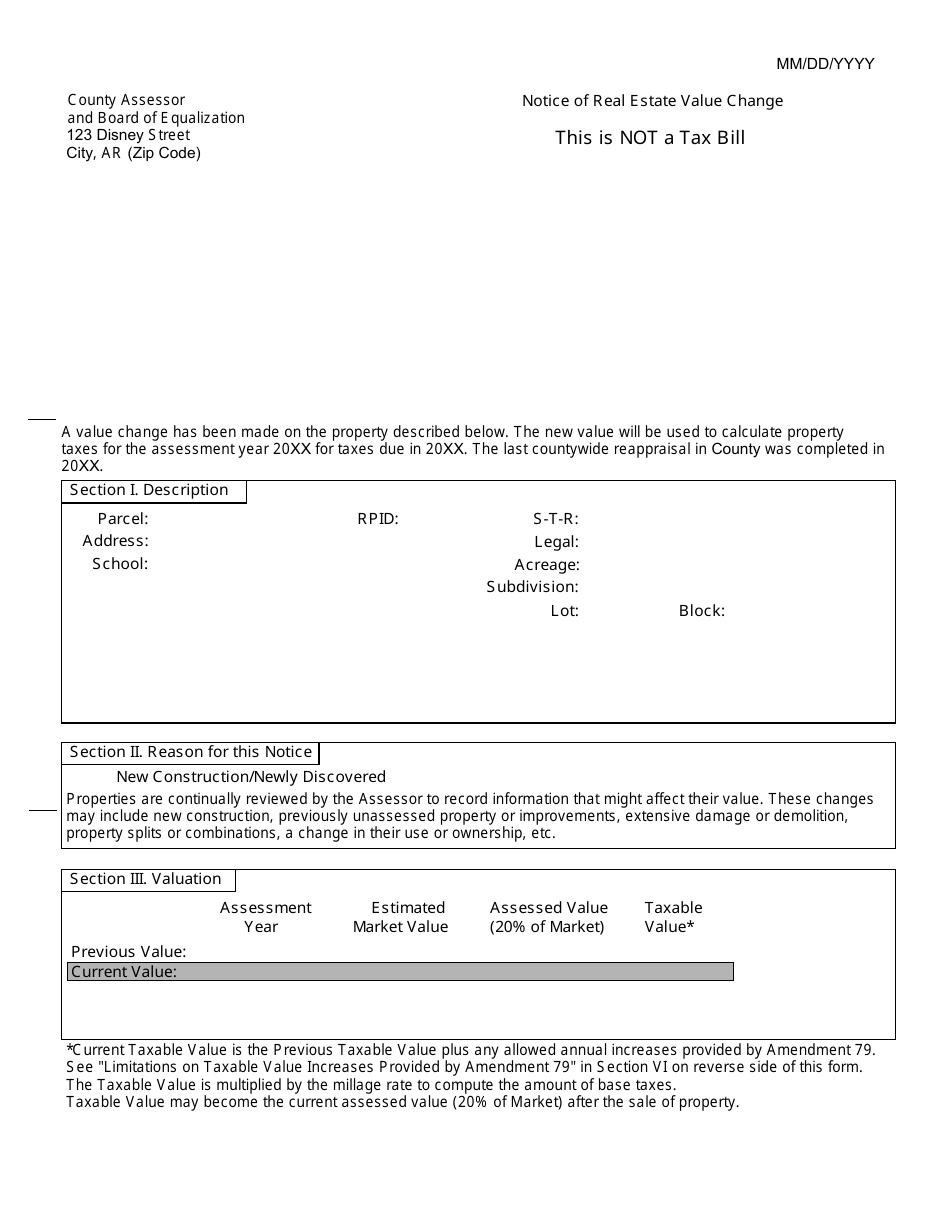

Form A 15 Download Printable Pdf Or Fill Online Notice Of Real Estate Value Change Arkansas Templateroller

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times